Our Captive Insurance Team knows the way.

Our firm's history in the statutory insurance industry made an easy transition to the captive path. We have been performing captive audit and tax work since captive law's inception and have added to our distinguished list of clients every year. Captive managers love working with us because of our efficient and accurate expertise, and because of our friendly captive team that keeps you updated on the status of your audit or tax return weekly.

CHECK OUT OUR LATEST CAPTIVE TAX GUIDE!

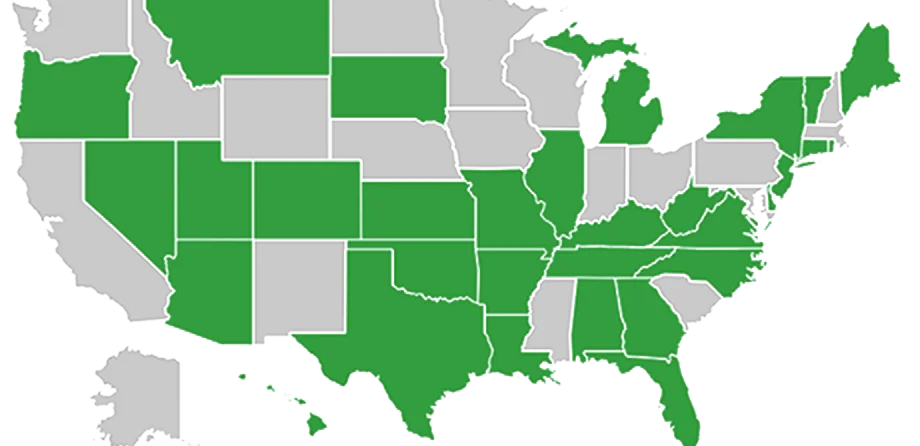

Coast-to-Coast Premiere Captive Audit + Tax Services

We currently serve over 200 captive entities with audit and tax services throughout the nation, and are licensed as captive CPAs in the following states highlighted green:

MEET THE CAPTIVE INSURANCE TEAM

Martha Hayes, CPA

Lead Captive Insurance Audit Partner

Daniel Bringhurst, CPA

Captive Insurance Audit Partner

Allison Johnson, CPA

Captive Insurance Audit Partner

Diane Nesbit, CPA

Captive Insurance Audit Partner

Scott Rogers, CPA

Captive Insurance Tax Partner

Craig Swindlehurst, CPA

Captive Insurance Tax Partner

THE PERFECT HISTORY FOR OUR CAPTIVE FUTURE

OUR CLIENTS LOVE US

Here’s what our clients have to say about Larson & Company:

"Larson & Company’s focus on the insurance industry and responsive service has brought efficiency and value to EMI over many years of being a client. Their focus on our area of risk has helped us navigate changes in our industry and helped us in every stage of our company’s growth. Because their staff is well trained, they do not waste time on nonimportant, peripheral matters during the audit, and their work is always timely, accurate, and properly prepared. They are easy to approach with any questions and are a great resource to us. We have always felt like an important client to Larson, and they are a fun group of people to work with."

— Stephen Clay, Controller, EMI Health

"I have found working with both the Audit and Tax departments of Larson and Company that their work has been professional, timely, accurate and affordable."

— Nathan West, Controller, Allied Guaranty Insurance Company

"Larson & Company is one of the most knowledgeable CPA firms in the insurance industry. They always give us sound feedback and provide us with significant time savings during our busiest time of year. They really provide an incredible value."

— David Plowman, Controller, Total Care Auto

"For many years, Larson & Company have been our auditors. They are experienced and well-trained experts in statutory accounting. They are great to work with – very pleasant, professional, accessible and helpful. They continually exceed our expectations and we couldn’t be more pleased."

— Byron Allen, President, American Savings Life Insurance Company

"WMI Mutual Insurance Company has worked with Larson & Company for decades. They are professional and competent CPAs, and their reputation and integrity is second to none. Their work is highly respected by regulators which saves costs during regulatory reviews and examinations."

— Dave Leo, President & CEO, WMI Mutual Insurance Company

Captive Association Membership

FREQUENTLY ASKED QUESTIONS – CAPTIVE INSURANCE

These FAQs provide an overview of captive insurance companies and the audit, tax, and advisory services needed to support effective risk management and regulatory compliance.

WHAT IS A CAPTIVE INSURANCE COMPANY?

A captive insurance company is a privately owned insurance entity formed by a business or group of businesses to insure their own risks. Instead of purchasing coverage from a traditional insurance carrier, the parent company uses the captive to provide customized insurance solutions, manage risk more effectively, and gain greater control over premiums and claims.

WHAT IS THE PRIMARY USE FOR FORMING A CAPTIVE INSURANCE COMPANY?

The primary purpose of forming a captive insurance company is to improve risk management while potentially reducing insurance costs. Captives allow organizations to tailor coverage to their specific risks, stabilize insurance expenses, access reinsurance markets, and, in some cases, achieve tax efficiencies when structured and managed properly under applicable regulations.

WHAT DOES A CAPTIVE INSURANCE AUDITOR DO?

A captive insurance auditor provides an independent examination of a captive insurance company’s financial statements to ensure compliance with accounting standards. Captive audits focus heavily on premium recognition, loss reserves, related-party transactions, and coordination with actuarial reports.

HOW IS A CAPTIVE INSURANCE AUDIT DIFFERENT FROM A TRADITIONAL INSURANCE AUDIT?

Captive insurance audits require specialized knowledge of risk transfer, risk distribution, intercompany arrangements, and regulatory expectations unique to captive domiciles. Unlike traditional insurance audits, captives involve closely held entities, related parties, and heightened regulatory and IRS scrutiny.

WHY IS IRS SCRUTINY A CONCERN FOR CAPTIVE INSURANCE COMPANIES?

The IRS closely examines captive insurance arrangements—particularly small captives under IRC §831(b)—to ensure they operate as real insurance companies. Key IRS focus areas include risk transfer, risk distribution, premium pricing, claims history, and proper documentation.

WHAT TYPES OF CAPTIVE INSURANCE COMPANIES DOES LARSON WORK WITH?

Our captive specialists typically work with single-parent captives, group captives, and risk retention structures across a range of industries. Some of these industries often include captives insuring operating companies, professional services firms, manufacturers, and middle-market businesses.

HOW DO YOU COORDINATE WITH CAPTIVE MANAGERS AND ACTUARIES?

Our captive specialists collaborate closely with captive managers and actuaries to align financial statements, actuarial reports, and regulatory filings. This coordination helps ensure consistency across audit, tax, and regulatory submissions.

HOW ARE PREMIUMS AND LOSS RESERVES HANDLED FOR CAPTIVE TAX PURPOSES?

Premiums must be actuarially supported, reasonable, and tied to real business risk. Loss reserves must be calculated consistently with actuarial reports and accounting standards. Conservative treatment and clear documentation reduce IRS risk.

WHAT ARE COMMON MISTAKES THAT CAUSE PROBLEMS FOR CAPTIVE INSURANCE COMPANIES?

Common issues include poorly documented risk transfer, unsupported premiums, limited claims activity, inadequate governance, and lack of coordination between auditors, actuaries, and captive managers.

WHAT INFORMATION DO YOU NEED TO GET STARTED WITH A CAPTIVE AUDIT OR TAX ENGAGEMENT?

Typical requirements include financial records, actuarial reports, captive agreements, claims data, prior filings, and operating company information. A structured onboarding process helps keep timelines predictable.

HOW FAR IN ADVANCE SHOULD A CAPTIVE INSURANCE COMPANY PLAN FOR AUDIT AND TAX FILINGS?

Planning should begin several months before filing deadlines. Early coordination allows time to resolve issues, align documentation, and avoid last-minute regulatory or tax complications.

WHEN SHOULD A CAPTIVE INSURANCE COMPANY RECONSIDER ITS STRUCTURE OR EXIT STRATEGY?

Captive owners should periodically review whether the captive still meets business, regulatory, and tax objectives. Changes in risk profile, regulations, or IRS guidance may signal the need for restructuring or an orderly unwind.

.png)