everything you need to know: the final IRS regulations for micro-captives

Detailed summaries of Regs. Sec. 1.6011-10 and 1.6011-11

NEW UPDATES FOR MICRO-CAPTIVES

Final regulations announced

On January 10, 2025, the Department of the Treasury (“Treasury”) and the Internal Revenue Service (“IRS”) issued final regulations (Regs. Secs. 1.6011-10 and 1.6011-11) related to micro-captive insurance companies. The final regulations outline when a micro-captive insurance company is deemed to be participating in a listed transaction or a transaction of interest and provides guidance on filing obligations for micro-captive insurance companies and related parties, including insured entities, owners, and material advisors.

LEARN MORE FROM OUR MICRO-CAPTIVE SERIES

The articles below go through the essential information contained in the Final Regulations.

- How Did We Get Here? The History of Notice 2016-66 and the Micro-Captive Regulations

- What Is a Listed Transaction, What Is a Transaction of Interest, and Why Does It Matter?

- When Is a Micro-Captive Insurance Company Deemed to Be Participating in a Listed Transaction?

- When Is a Micro-Captive Insurance Company Deemed to Be Participating in a Transaction of Interest?

- Flowchart: Determining Whether a Micro-Captive Transaction is a Listed Transaction or a Transaction of Interest

- What Are the Reporting Requirements for a Micro-Captive Insurance Company That Is Deemed to Be Participating in a Listed Transaction or a Transaction of Interest?

- What Information Is Required to Be Reported on Form 8886, Reportable Transaction Disclosure Statement, with Respect to Micro-Captive Listed Transactions and Transactions of Interest?

- How Can a Micro-Captive Revoke Its Section 831(b) Election?

- What Is a “Successor Captive” and What Do the Final Regulations Say About Them?

Current Developments & Litigation Updates

We highly recommend you contact a member of the Larson captive team to discuss the aspects of these regulations that apply directly to your captive to ensure you have the most applicable information for your situation.

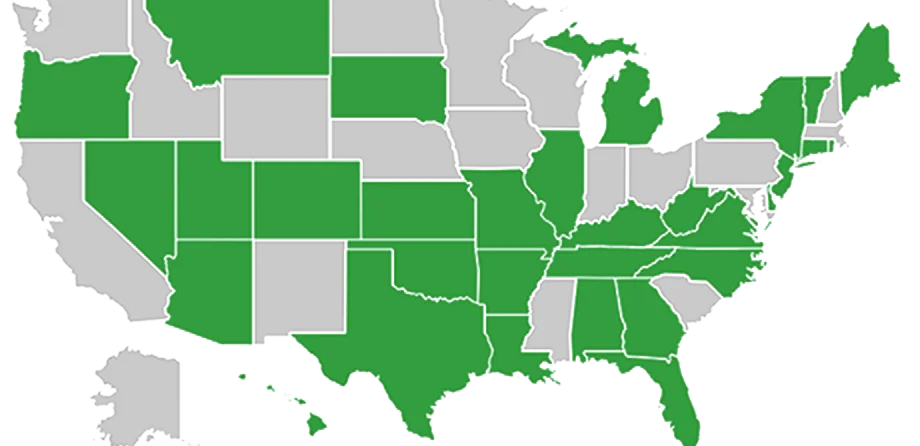

Coast-to-Coast Premiere Captive Audit + Tax Services

We currently serve over 250 captive entities with audit and tax services throughout the nation, and are licensed as captive CPAs in the following states highlighted green:

.png)