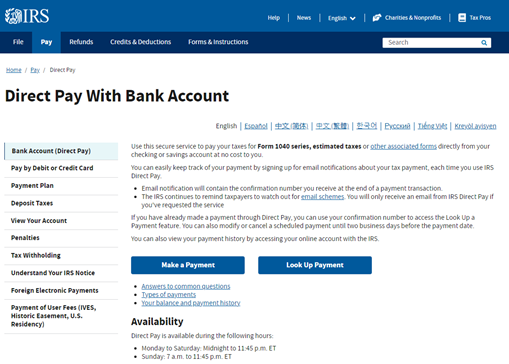

The IRS accepts debit and credit card payments, but there is a fee charged. The easier and free way to pay is by using the IRS’ Direct Pay system. Payments using this method will come straight out of your checking or savings account.

Below are the step-by-step instructions on how to utilize this payment option:

1. Go to https://www.irs.gov/payments/direct-pay

2. Click “Make a Payment”

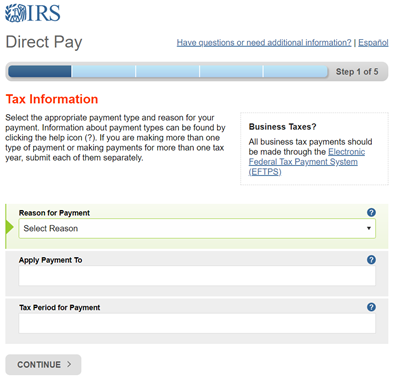

3. On the next screen, there are several drop down items for which you will need to make a selection.

a. Reason for Payment – There are many different options available, but the most common reasons are:

- Balance Due – Use this option when you owe tax with your tax return.

- Estimated Tax – Use this option when making quarterly estimated tax payments.

b. Apply Payment To – If you are paying regular income taxes you will select “Income Tax – Form 1040”

c. Tax Period for Payment – Select the tax year for which you are making a payment.

Once all the selections are made, click “Continue.”

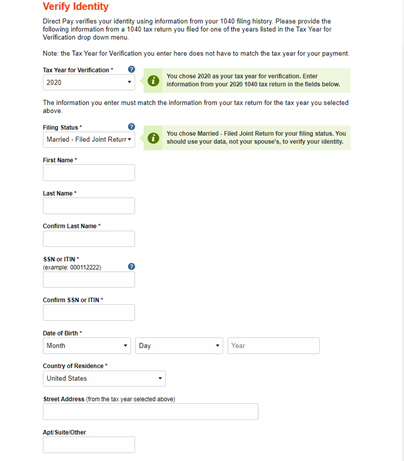

4. The next page will require you to verify your identity. The way the IRS does this is by asking for information from a previously filed tax return. In the dropdown “Tax Year for Verification,” select a prior tax year and then provide the following information from that year’s tax return:

- Filing Status

- Name

- Social Security Number

- Birth Date

- Address

Remember, do not provide your current information. Rather, provide the information from the year you selected. For example, if you selected to verify your identity using your 2021 tax return, include the address you used on your 2021 tax return, even if you have since moved.

Once you have input the correct information from your prior year tax return, click “Continue.”

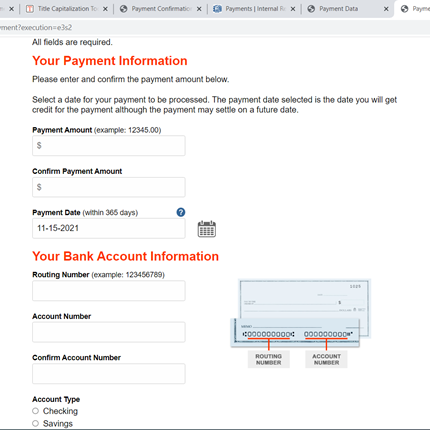

5. The next page asks for your payment information. Input the payment amount along with your routing number, account number, and the type of account you are using (checking or savings). For your records you are also able to request email confirmation of your tax payments. Once all the information is input click “Continue.”

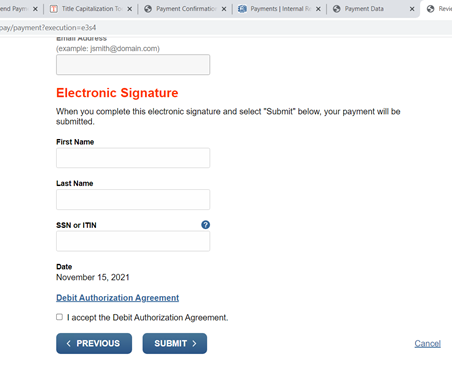

6. The final page asks you to review your tax payment. At the bottom of the screen it will ask for an electronic signature, which will consist of you typing your first and last name and providing your social security number again.

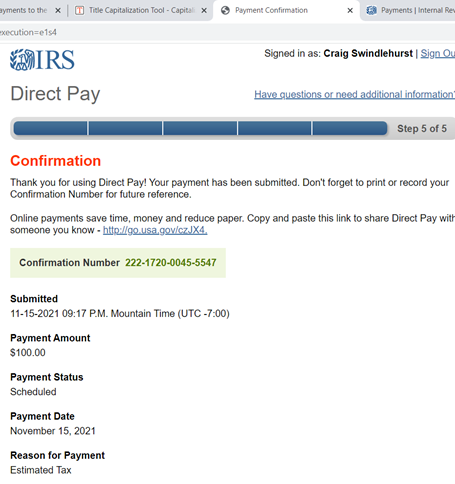

7. Clicking “Submit” will submit the payment and take you to a confirmation page that looks like this:

You can use the “Confirmation Number” to lookup this payment by going to https://www.irs.gov/payments/direct-pay and selecting “Look Up Payment.”

That’s it! IRS Direct Pay is an easy way to make tax payments online, save on postage, and receive electronic records of payments made.

For more information about paying your personal taxes online, please contact Larson & Company today.

.png)