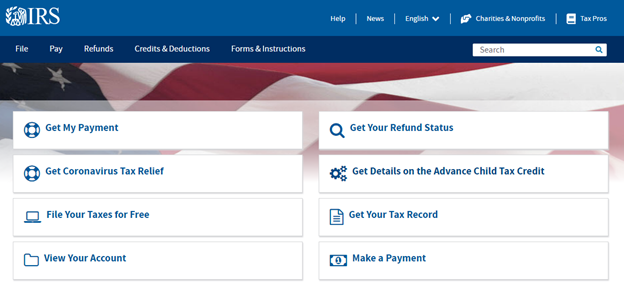

Here’s what the top of the Homepage looks like:

- Get My Payment

- Contains information related to the status of your 3rd Round Economic Stimulus Payment

- Get Coronavirus Tax Relief

- Contains information about Advance Child Tax Credit and Economic Stimulus Payments

- File Your Taxes for Free

- Contains links to free services for federal income tax filing from outside vendors for those with income of $72,000 or below or Free File Fillable forms for those with income over $72,000

- View Your Account

- See detailed info below

- Get Your Refund Status

- Allows one to check the status of an expected refund for the current tax filing

- Get Details on the Advance Child Tax Credit

- Contains information regarding the Advance Child Tax Credit and a link to manage payments

- Get Your Tax Record

- Contains information about how to get tax transcripts, either online through “View Your Account” or by mail with a link to request a transcript

- Make a Payment

- Contains information about making tax payments

- Can be done without creating an account

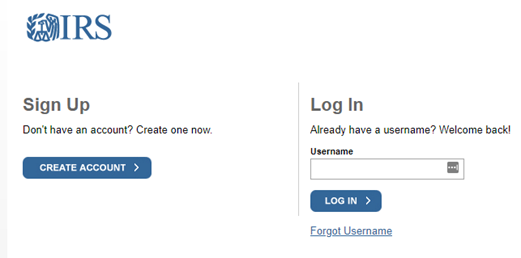

View Your Account

This link allows you to access your IRS records, make payments, access transcripts, etc.

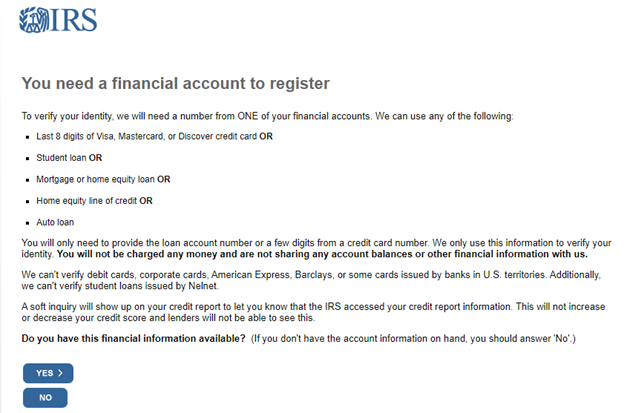

Creating an account is usually simple but some people run into issues. One of the ways the IRS verifies your identity is by having you provide information for a financial account, like a credit card. They won’t charge your card. They have access to a database that allows them to verify the user based on the financial information provided.

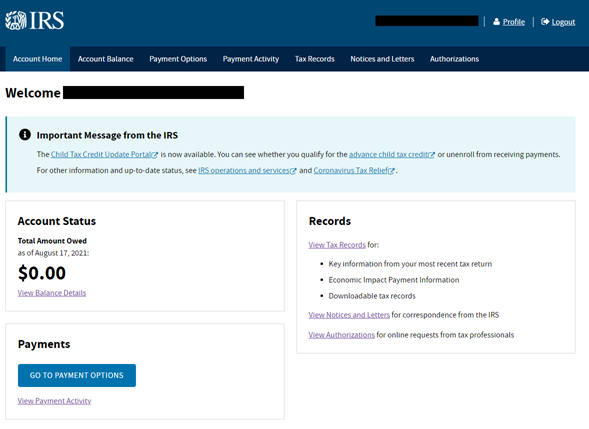

Once you’ve successfully created your account, here is what it will look like:

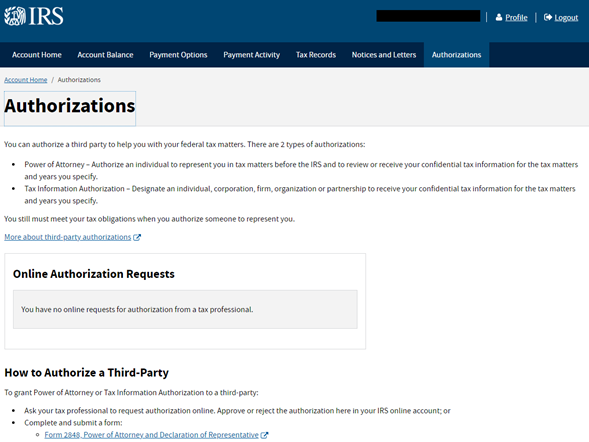

If ever needed, you can authorize your CPA to access your account info under the “Authorizations” item in the top menu.

Knowing your way around the IRS website and how to utilize its features can really save you a lot of time getting information about your tax status. For more help with navigating the IRS website, contact your Larson advisor today.

.png)