Generation Z, Millennials, and the Future of the Insurance Industry

July 27, 2023

I would consider myself a typical Millennial with the typical Millennial background and stereotypes. As a Millennial, and with close friends/family considered Gen Z, we are thinking about insurance differently than any generation before us. We are now the dominant buyers of insurance products, [1] and we have already made big impacts on insurance based on how we grew up and what our values are. Understanding our background, issues, and concerns can help insurance companies differentiate themselves from others with our generations, and see where insurance is headed in the future.

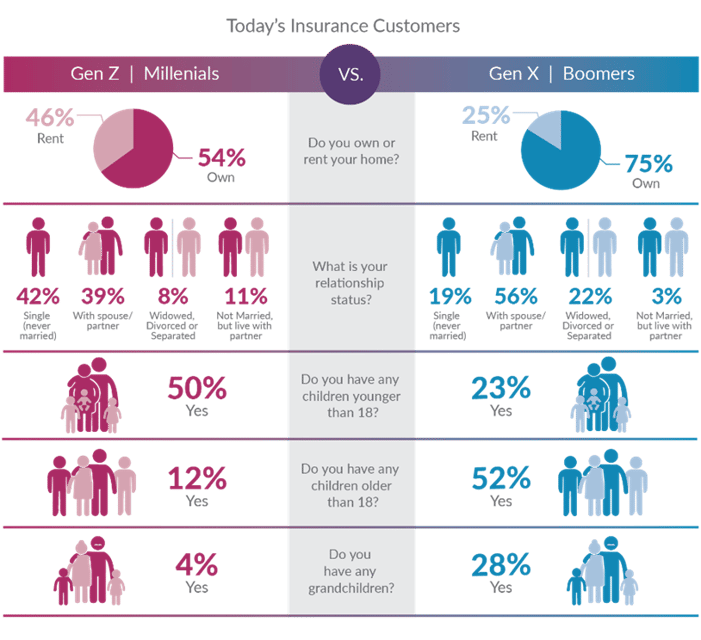

Millennials generally include individuals born between 1981-1996, and Gen Z 1997-2015. Gen Z accounts for 25% of the U.S. population and combined with millennials, we represent almost 50% of the U.S. population.[2] We share many of the same experiences and are often grouped together in studies and research. We are considered the most racially and ethnically diverse generation yet. According to research by American Psychological Association, of all generations in the work force Gen Z has the worst mental health.[3] Money is a big stressor. We, Millennials and Gen Z, watched our parents during the 2008-2009 recession as kids. We have growing student loan and credit card debt, and the increase in inflation and house prices makes it hard to find affordable housing. A high percentage of us remain single and not married, but with partners. We are renting more instead of owning homes. We are waiting to have children later in life. We don’t compartmentalize areas of our life, especially since COVID 19. Work used to be just work, home used to be just home. Now work is at home, the home car is used for work, and lines are getting blurred. See Figure 1 for more comparisons on our generations. [4] These significant lifestyle changes compared to the older generations and our unique history reflect greatly on our insurance needs.

We are known as the generation that grew up in the digital age, and it’s no surprise that digitalization is exactly what we want with insurance. In 2021 Capco, a global technology and management consultancy company, conducted a global insurance survey[5] showing the 61% of Gen Z and Millennials want a better digital experience and greater transparency of products and services. 43% of Gen Z respondents to the survey say they don’t feel confident in their insurance knowledge. We don’t want to sift through 30-40 pages of a policy to understand what we are buying. We want immediate responses and satisfaction with our insurance products, mainly through apps and a greater online experience. With online experiences and digital products comes hyper-personalization. We want insurance products specifically tailored to our needs to get cheaper insurance premiums. Value for money is still a high priority for us based on our generation’s history. We will look online for discounts, compare prices, and read online reviews when deciding to buy. Brand loyalty is diminished with Gen Z and Millennials, we focus on value for price. In the Capco survey, 90% of Gen Z and 75% of Millennials are willing to share personal data with insurance companies to get a personalized premium. This includes sharing driving history from our smartphones, health data from our smartwatches, social media data, and other smart home devices. Hyper-personalization for assorted products can also be bundled together to cover multiple areas of our lives since our generation is becoming less compartmentalized. Insurance is becoming more digitized to create clear, concise, and personalized insurance products for Gen Z and Millennials.

Focusing on our background and history can help guide insurance companies to where we will find value. For example, life insurance is usually for individuals with dependents to care for. With Gen Z and Millennials delaying or not having children, insurance companies can focus on life insurance policies that are customizable to support a particular cause or leave a legacy. We are seeing an increase in rent insurance, pet insurance, and mobile phone/gadget insurance, all due to our different values. The future of the insurance industry is changing to focus on the needs and concerns of the upcoming generations, and this growth is essential for insurance companies to understand for long-term success.

[1] https://iireporter.com/big-changes-for-insurance-gen-z-millennials-make-bold-moves/

[2] https://www.propertycasualty360.com/2020/01/08/insights-into-generation-z-what-insurers-should-know/

[3] https://www.propertycasualty360.com/2020/01/08/insights-into-generation-z-what-insurers-should-know/

[4] https://iireporter.com/big-changes-for-insurance-gen-z-millennials-make-bold-moves/

[5] https://www.capco.com/intelligence/capco-intelligence/the-future-of-insurance

Tori is an Audit Manager for Larson and Company. She specializes in providing audit services and data analytics services for insurance companies.

LinkedIn

.png)