Discounting for Multiyear Unconditional Promise to Give

January 22, 2024

Nonprofit organizations rely heavily on contributions from donors to fulfill their mission. Accounting for these contributions requires thoughtful consideration and compliance with accounting standards (GAAP). One type of contribution a nonprofit organization may receive is a multiyear unconditional promise to give. While this type of promise to give does not have any stipulations for revenue recognition, it is classified as a net asset with donor restriction (for time) and must be adjusted for the time value of money.

In order to properly account for this type of contribution the nonprofit organization must estimate the fair value of the promised contribution. Any amount expected to be received within one year can be measured at net realizable value. This is because the value is not expected to significantly change within the year. To accurately represent the value(s) from every subsequent year moving forward, the organization needs to consider the present value of future cash flow by discounting the receivable using an appropriate interest rate.

The appropriate interest rate or discount rate used by the nonprofit organization relies on several factors. A few factors to consider would be:

- Risk-free rate which represents no risk of financial loss.

- Risk premiums can be added to the risk free rate to account for a specific risk associate with the receivable or donor.

- Discount rates may also take into account future inflation to ensure that the value takes into account the loss of purchasing power over time.

Organizations can use a combination of factors to determine the most suitable discount rate for a particular promise to give.

Once the multiyear unconditional promise to give has been received the nonprofit organization should discount the total amount due after one year. This means that the total discount should be established when the amount is initially recognized. The amount should not be revised unless the nonprofit has elected the subsequent fair value measurement (this election must be made at the point of initial recognition and is irrevocable for the life of the asset). Each year when the receivable has been collected the nonprofit organization would recognize the discount for that particular year as additional contribution.

Properly accounting for multiyear unconditional promises to give is critical for nonprofit organizations to comply to GAAP standards and maintain transparency with reporting practices and donors.

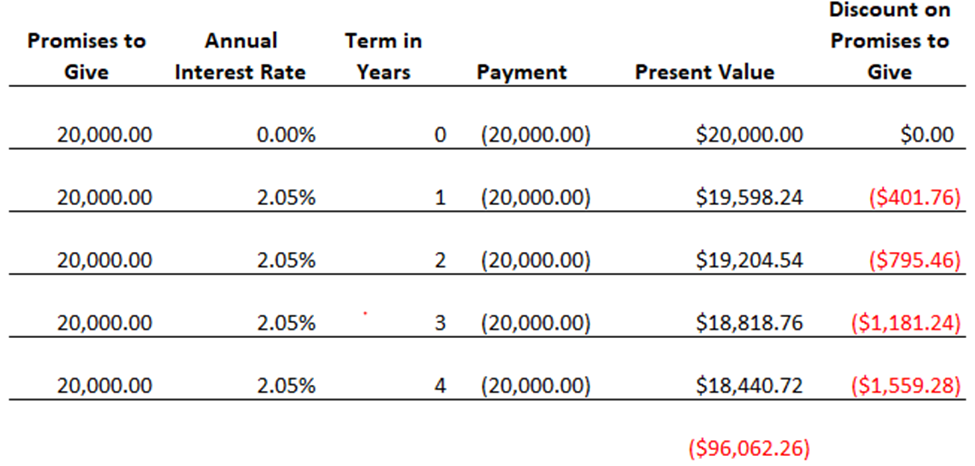

Exhibit:

Total multiyear unconditional promise to give: $100,000 over 5 years with a discount rate of 2.05%

Excel formula: =PV(2.05%,5years,20000,,1): calculates total future value

Example of schedule initially established- Example of initial entry-

Example of initial entry-

Contribution receivable: 100,000

Contribution revenue: 96,062.26

Discount on promise to give: 3,937.74

Example of entry to remove discount-

Contribution revenue: 401.76

Discount on promise to give: 401.76

For more information about this topic, please contact Larson & Company today!

Valerie is an Audit Manager at Larson & Company. She specializes in audits for a wide range of nonprofit clients.

LinkedIn

.png)