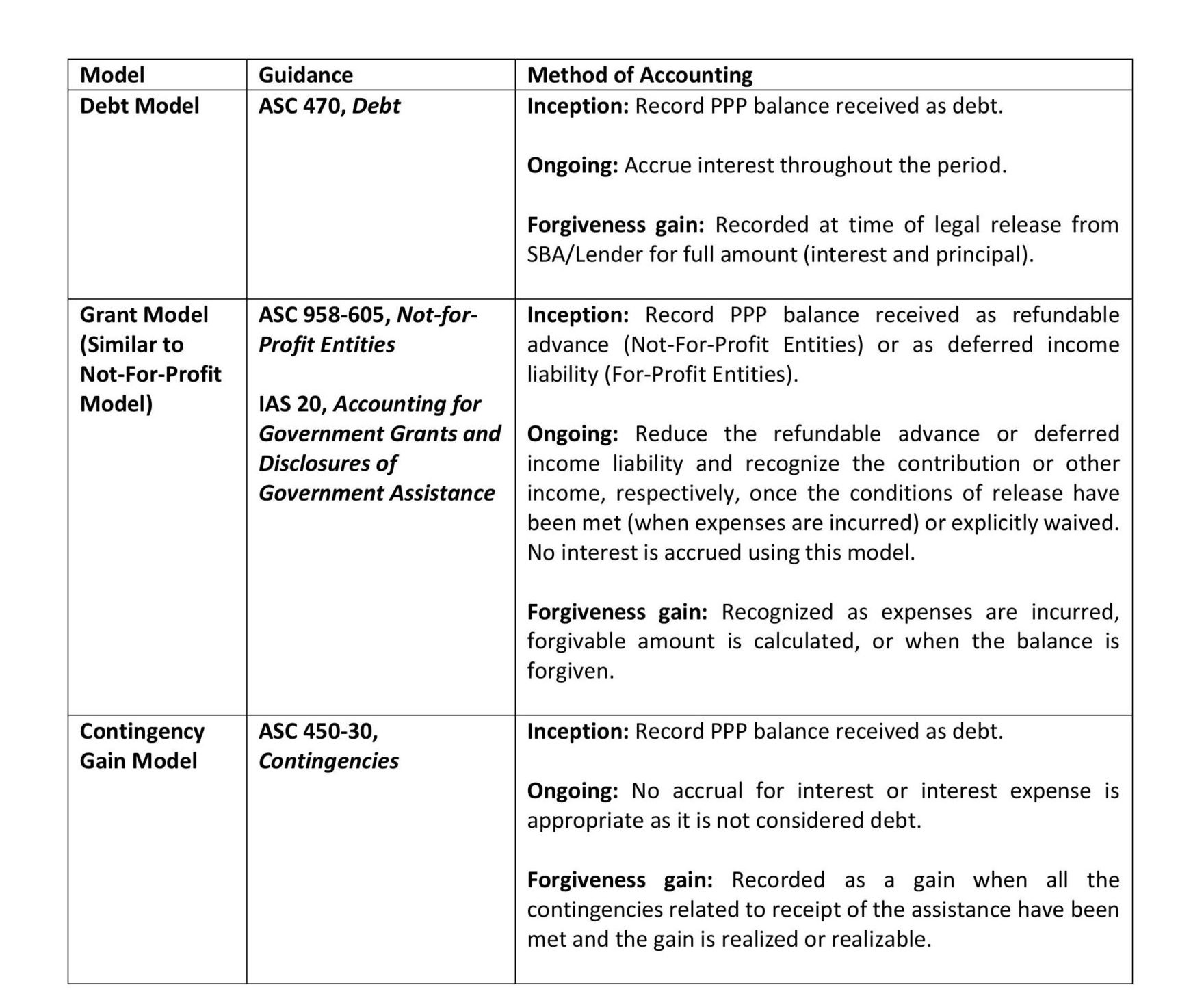

Most for-profit entities are using the Debt Model to account for PPP funds received. When applying these methods, entities should remember the following:

- Entities do not need to impute interest as rates prescribed by government agencies are excluded from guidance on imputing interest.

- Interest still needs to be accrued for Debt Model accounting even though you expect the full amount to be forgiven. Terms of the PPP are typically 1% interest per annum.

- When presenting classified financials, current and long-term portions of the loan should be considered and reported appropriately. Even though payments may be deferred, the loan is still due 2 years from the inception of the loan. Principal payment periods should be considered and disclosed depending on when the payment deferral period ends based on whether the forgiveness application has been filed.

- If the Grant Model is implemented, entities need to keep careful documentation to support the amount of PPP balance utilized for qualified expenses as evidence that the release of refundable advance or deferred income liability is appropriate.

- If the Contingency Gain Model is implemented, entities should have appropriate evidence to support that all contingencies related to receipt have been met and the gain is realized or realizable. Some evidence to consider include the following:

- All PPP funds are used for qualified expenses

- No reduction in headcount or salaries

- Forgiveness application has been filed and accepted prior the end of the reporting period

- Formal forgiveness letter was received subsequent to the reporting period

- For Cash Flow reporting, the reporting may change depending on what model you chose:

- Debt Model – proceeds and repayments are reported as financing activities, with interest payments reported as operating activities. Forgiveness of debt will be reported as a non-cash financing activity within the supplemental disclosures.

- Grant Model – amounts expected to be forgiven are reported as operating activities and amounts not expected to be forgiven are reported as financing activities. All other cash flows are reported as operating activities.

- Gain Contingency Model – All cash flows are reported as operating activities.

For more information about accounting for PPP Loans, contact your Larson & Company advisor.

.png)